Our approach toward net zero

Deutsche Bank pursues a holistic approach to net-zero transition. This covers the emissions from the bank’s own operations (Scope 1 and 2); its Supplychain (Scope 3, Category 1–14); and emissions arising from financing its clients’ net-zero transition (Scope 3, Category 15). The biggest challenge to achieving our 2050 net-zero target is decarbonizing our lending portfolios, in particular the European residential real estate portfolio and our global corporate loan portfolio. Partnering with our clients to support them on their path toward net zero is the most important lever for Deutsche Bank’s contribution to the transition of the real economy. At the same time, we are convinced that we can only be a credible partner for our clients and articulate our expectations for their decarbonization if we lead by example, by transforming our own operations and supply chain.

Carbon footprint status quo

Scope 1 and 2

Own operations

331

Scope 3 (Category 1–14)

Supply chain

1,0781

Scope 3 (Category 15)

European residential real estate exposure

2,233

Scope 3 (Category 15)

Corporate loan exposure - committed; thereof: 31,993 drawn

64,742

¹ Data reported for 2024 is from the period October 1, 2023 to September 30, 2024

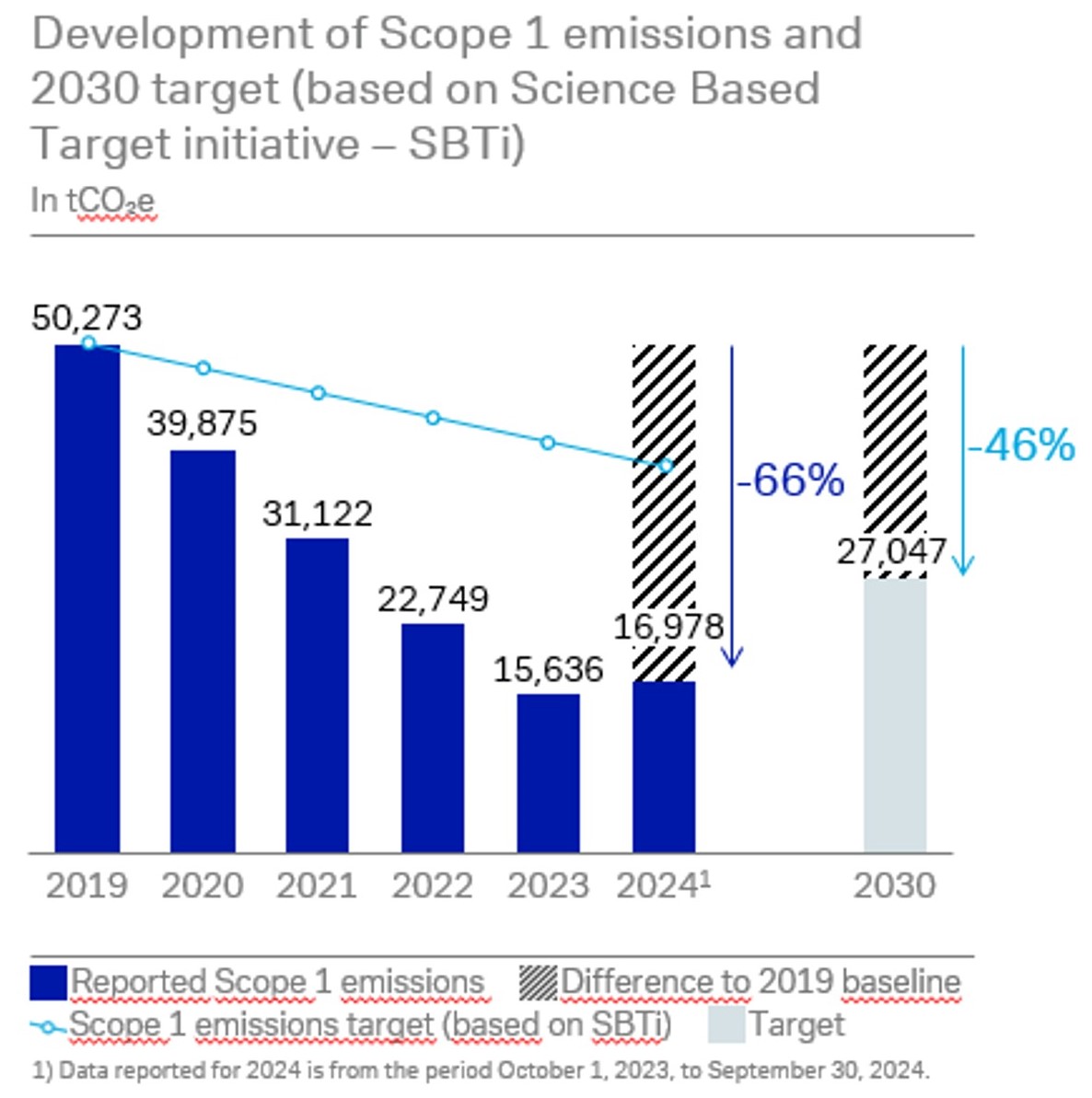

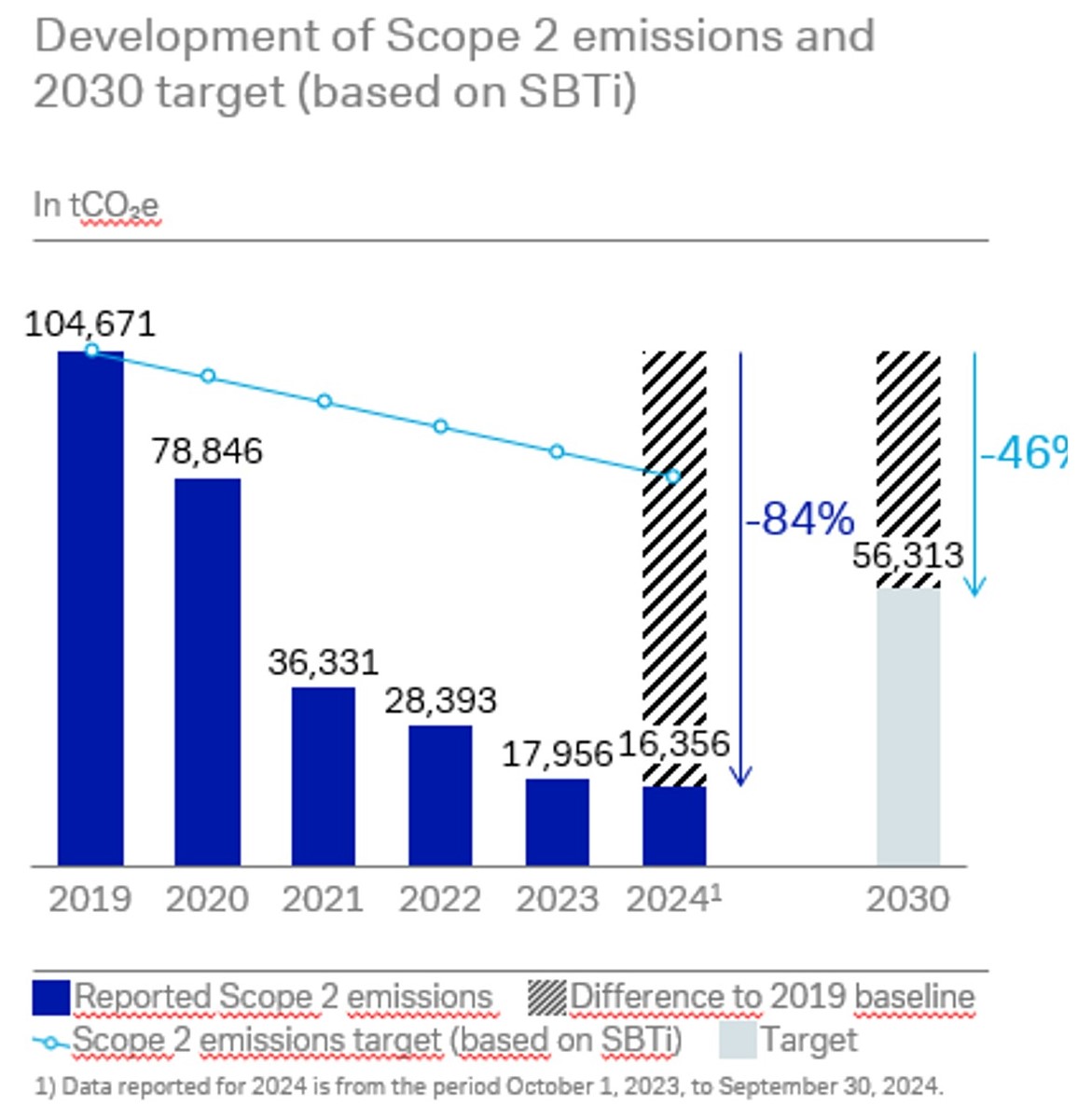

Our own operations and supply chain emission reduction targets

As of September, 2024, the Scope 1, 2, and 3 (Category 1–14) emissions associated with the bank’s own operations and supply chain totaled 1.1 MtCO2e. The overwhelming majority of these emissions, or 97%, arises from the bank’s supply chain. Externally purchased goods and services (Scope 3, Category 1) are the largest contributor, accounting for 61%. Significant progress has been made in decarbonizing the bank’s own operations and supply chain. From 2019 to the end of the third quarter of 2024, Deutsche Bank reduced Scope 1 and 2 emissions by 79% or 122 KtCO2e, and Scope 3 (Category 1–14) emissions by 45% or 881 KtCO2e. The key levers for achieving the net-zero targets based on the Science Based Target initiative (SBTi) differ across emissions scopes, but follow a strategic approach that focuses on the areas of greatest impact.

Development of Scope 3 emissions (Category 1-14) and 2030 target (based on SBTi)

As an active participant in the Carbon Disclosure Project (CDP) Supply Chain program, Deutsche Bank improved its methodology to calculate supplier-specific GHG emission data. The resulting changes affect the bank’s progress towards its 2030 net-zero targets and the comparability of reported emissions against the bank’s calculation baseline. The bank will disclose an adjusted year-on-year comparison of its Scope 3 (Category 1 – 14) GHG emissions later in 2025.

Ambition Level

Scope 1 and 2: Reduce total energy consumption by 30% by 2025 compared with 2019

Scope 3 (Category 1): 80% of total vendor spend expected to submit greenhouse gas emissions to the Carbon Disclosure Project (CDP) by 2025

Our financed emission reduction targets

As of year-end 2024 Deutsche Bank’s financed emissions total 34.2 MtCO2e/y. 94%, or 32 MtCO2e/y (equivalent to 64.7 MtCO2e/y on the basis of total loan commitments), derive from its €117.7-billion corporate loan portfolio. The remaining 6%, or 2.2 MtCO2e/y, derive from the bank’s €166.4-billion portfolio of loans secured by European residential real estate.

Corporate loan portfolio

Deutsche Bank has set 2030 and 2050 decarbonization targets for the eight most carbon-intensive sectors: Oil & Gas (Upstream), Power Generation, Automotive (Light Duty Vehicle), Steel, Coal Mining, Cement, Shipping, and Commercial Aviation. To achieve these targets, Deutsche Bank is partnering with its corporate clients and pursuing three financing strategies: providing financing and assisting companies that enable emission reduction through their range of green products and services (green/sustainable), supporting companies that have embarked on the journey of decarbonizing their business models (transition), and phasing out business with not-to-abate industries and with clients not willing to align to our transition pathway (phase-out).

2030 decarbonization targets compared to the base year 2021/22/23⁴

In MtCO₂/y

Oil & Gas – Upstream

-23%

In kgCO₂e/MWh

Power Generation

-69%

In gCO₂/vehicle km

Automotive – Light Duty Vehicle

-59%

In kgCO₂e/t steel

Steel

-34%

In MtCO₂

Coal mining

-49%

In kgCO₂e/kg cement

Cement

-29%

In % (Poseidon Principles Alignment Score)

Shipping

0%

In % (Pegasus Guidelines Alignment Scote)

Commercial Aviation

0%

⁴ Oil & Gas (Upstream), Power Generation, Automotive (light duty vehicle) and Steel have the baseline year 2021, Steel, Coal mining, cement and shipping have the baseline year 2022, Commercial Aviation has the baseline year 2023.

European residential mortgage portfolio

Around 13 million properties, or 67 % of total properties in Germany, were built prior to 1979 with no energy efficiency requirements. Of the bank’s € 166.4 billion European residential real estate portfolio, as of year-end 2023 92% comprises residential mortgages in Germany. Setting decarbonization targets for homeowners, as we have for the corporate loan portfolio, would risk restricting the flow of financing into energy-efficient housing and penalizing private citizens at a time of inflationary pressures and rising interest rates. Accordingly, Deutsche Bank looks forward to publishing its net-zero pathway for the European residential real estate sector once better-quality data becomes available and a clearer assessment emerges of evolving trends impacting this area. The bank’s approach toward managing the emissions linked to the European residential mortgage portfolio goes beyond pure financing and focuses on supporting clients to navigate all aspects of the energy-efficient refurbishment of their property.

Deutsche Bank seeks to widen the scope of its carbon reduction in its client activities in three areas: carbon footprint of capital market transactions; net-zero targets for additional portfolios; and opportunities to reduce emissions from private clients’ assets under management.

Read more in our report

Show content of Disclaimer

The transition to a sustainable economy is a long-term undertaking. In its current stage, we are confronted with the limited availability of climate related data. Use of estimates and models is inevitable until improved data becomes available. Our expectations for increasing data quality are based on reporting obligations as currently developed. New regulations on reporting will likely become effective in the coming years. Harmonized standards and calculation methods are expected to be developed and will also improve data quality.

The sustainability targets on this website includes metrics that are subject to measurement uncertainties resulting from limitations inherent in the underlying data and methods used for determining such metrics. The selection of different, but acceptable measurement techniques can result in materially different measurements. The precision of different measurement techniques may also vary. The information set forth herein is expressed as of end of October 2023, and we reserve the right to update its measurement techniques and methodologies in the future.

We have measured the carbon footprint of our corporate loan portfolio in accordance with the standards we discuss in our report on corporate loan portfolio financed emissions and net-zero-aligned pathways for focus sectors (Towards net-zero emissions). Furthermore, we have measured the carbon footprint of our European Real Estate loan portfolio in accordance with the standards we discuss in our report on Residential Real Estate – Leading to Net-zero. In doing so, we partly used information from third-party sources that we believe to be reliable, but which has not been independently verified by us, and we do not represent that the information is accurate or complete. The inclusion of information contained in on this website should not be construed as a characterization regarding the materiality or financial impact of that information.

If emissions have not been publicly disclosed, these emissions may be estimated according to the Partnership for Carbon Accounting Financials (PCAF) standards. For borrowers whose emissions have not been publicly disclosed, we estimate their emissions according to the PCAF emission factor database. Since there is no unified source of carbon emission factors (including sustainability-related database companies, consulting companies, international organizations, and local government agencies), the results of estimations may be inconsistent and uncertain.

Past performance and simulations of past performance are not a reliable indicator and therefore do not predict future results.

This website contains forward-looking statements. Forward-looking statements are statements that are not historical facts; they include statements about our beliefs and expectations and the assumptions underlying them. These statements are based on plans, estimates, and projections as they are currently available to the management of Deutsche Bank Aktiengesellschaft. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to publicly update any of them in consideration of new information or future events. By their very nature, forward-looking statements involve risks and uncertainties. Several important factors could therefore cause actual results to differ materially from those contained in any forward-looking statement. Such factors include the conditions on the financial markets in Germany, in Europe, in the United States, and elsewhere, from which we derive a substantial portion of our revenues and in which we hold a substantial portion of our assets; the development of asset prices and market volatility; potential defaults of borrowers or trading counterparties; the implementation of our strategic initiatives; the reliability of our risk management policies, procedures and methods; and other risks referenced in our filings with the U.S. Securities and Exchange Commission. Such factors are described in detail in our most recent SEC Form 20-F under the heading “Risk Factors.” Copies of this document are readily available upon request or can be downloaded from our website.