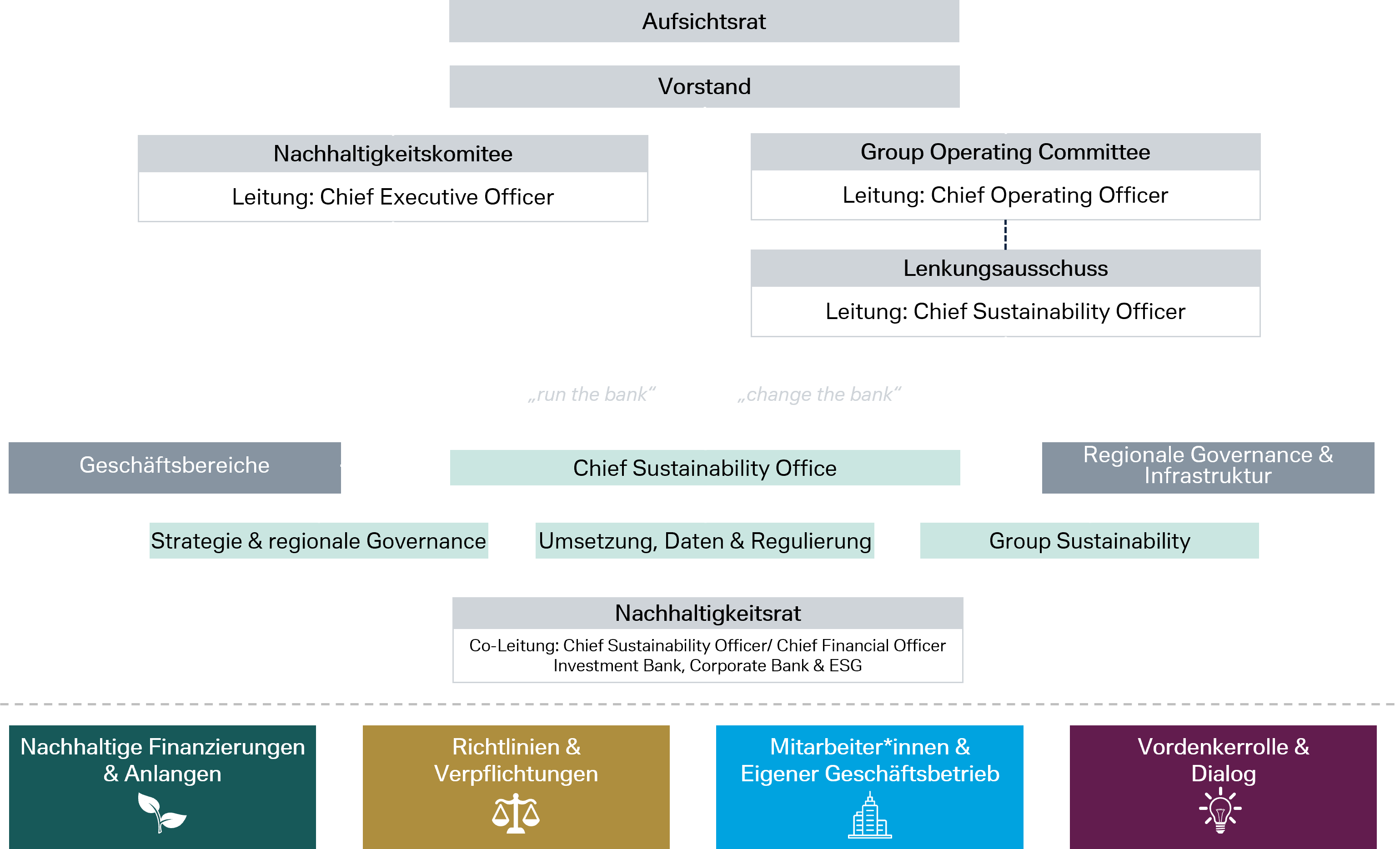

Our sustainability governance structure helps to manage, measure, and control sustainability activities across divisions and regions and allows for compliance with relevant environmental and social regulations.

The Chief Sustainability Officer reports to the Chief Executive Officer. He has the mandate to develop the bank’s sustainability strategy and advance its implementation and also covers the coordination of the work of the Group Sustainability Committee as Vice-Chair of the CEO, the Sustainability Strategy Steering Committee as Chairman, and the Sustainability Council as Co-Chairman. Besides he reports progress into the Management and Supervisory Board.

The bank supplemented its existing Group Sustainability team with a dedicated Strategy team as well as an Execution team, for managing the transformation on a day-to-day basis. All three teams form the bank’s new Chief Sustainability Office. Group Sustainability retains its responsibility for advancing the bank’s sustainability framework, overseeing adherence to group-wide sustainability policies and commitments, and providing transparency to the bank’s stakeholders. The Strategy and the Execution team focus on setting and refining the bank’s sustainability strategy and transformation program as well as its implementation. In addition to the Chief Sustainability Office, the bank’s business divisions and infrastructure functions have their own ESG expert groups to ensure a swift response to business opportunities and potential risks.

The bank has several fora devoted entirely to sustainability. The most senior forum is the Group Sustainability Committee which was created in 2020 and acts as main governance body for sustainability related matters across Deutsche Bank Group. The Management Board has delegated sustainability related decisions to this committee, which is chaired by the Chief Executive Officer and the Chief Sustainability Officer (Vice Chair). It consists of Management Board members, and the heads of the bank’s business divisions (members of the GMC) as well as infrastructure functions. The committee acts as senior decision-making body for sustainability-related matters on group level. Its “run the bank”-mandate has oversight of the sustainability strategy implementation across divisions and also ensures alignment of the sustainability strategy with the client centric pillar of the bank’s corporate strategy. In 2023, the Group Sustainability Committee met four times. Topics that were discussed among others were sustainability strategy, financed emissions, carbon disclosure.

The second forum is the Sustainability Strategy Steering Committee which was formed in 2022. It is chaired by the Chief Sustainability Officer, Vice-Chair is the Chief Financial Officer Investment Bank, Corporate Bank & ESG. It consists of divisional and regional ESG specialists of the business divisions and certain infrastructure functions and meets monthly. It has delegated responsibility (by the CEO) for overseeing the implementation of the sustainability strategy as one of the banks “Key Deliverables” (“change the bank”-responsibility). The members of the committee collaborate across organizational boundaries. The Key Deliverable Sustainability Strategy is organized in work streams and their objectives are divided as follows:

- Sustainability Data & Technology: Integration of ESG data into existing infrastructure and development of new technology components

- Empowerment & Training: ensures the alignment and training of staff worldwide

- ESG Financing: conceptualizes the asset and liability management in the ESG space

- Net-Zero Alignment Strategy: develops net-zero targets and client transition dialogue approaches in close collaboration of Risk, business divisions and Chief Sustainability Office (two separate workstreams for the Private Bank as well as the Corporate Bank and the Investment Bank)

- Risk, Controls & Governance: designs the sustainability control framework and oversees its implementation

- Materiality Analysis and Reporting: sets up and drives the implementation of CSRD and identifies ESG KPIs to be embedded into DB performance management

- Nature: integrates Nature into DB’s governance & processes

All of these work streams have charters, measurable targets and detailed implementation plans, which are centrally tracked and supervised by the Sustainability Strategy Steering Committee. Escalations are reported into the Group Operating Committee, which is responsible to most effectively support the delivery of the bank’s overall strategy. Besides this, the program’s progress is as well reported to the Group Sustainability Committee on a regular basis. In 2023, this Steering Committee met eleven times. A third forum is the Sustainability Council, which Deutsche Bank formed in 2018. Its mandate is to foster knowledge exchange in the bank, in order to stimulate bank-wide change and to identify new topics. The council is co-chaired by the Chief Sustainability Officer and the Chief Financial Officer Investment Bank, Corporate Bank & ESG. The council met four times in 2023, discussing new internal development, business highlights, and market trends.

Sustainability governance bodies

| Governance body | Chairs | Members | Mandate | |

|---|---|---|---|---|

| Organisation level |

Group Sustainability Committee |

– Chair: Chief Executive Officer |

– Heads of business divisions |

– Acts as senior decision-making body for sustainability-related matters on Group level |

| Sustainability Strategy Steering Committee |

– Chair: Chief Sustainability Officer |

– Senior sustainability specialists of business divisions and infrastructure functions | – Responsible for overseeing the implementation of the sustainability strategy as one of the bank’s key deliverables on a day-by-day basis | |

| Group Risk Committee (Management Board level) |

– Chair: Chief Risk Officer – Vice Chair: Chief Financial Officer |

– Senior finance and risk specialists from various risk disciplines | – Approves new or changed material risk & capital models and reviews the inventory of risks, high-level risk portfolios, risk exposure developments, and Group-wide stress testing results – Approves internal climate transition risk appetite – Reviews and recommends items for Management Board approval, e.g., key risk management principles, the Group risk appetite statement, overarching risk appetite parameters – Supports the Management Board during Group-wide risk and capital planning processes |

|

| Enterprise Risk Committee | – Chair: Head of Enterprise Risk Management – Vice Chair: Head of Market Risk Management, Americas |

– Senior risk specialists from various risk disciplines | – Focuses on enterprise-wide risk trends, events, and cross-risk portfolios – Approves the group risk inventory, certain country- and industry-specific threshold increases, and scenario design outlines for more severe group-wide stress tests as well as reverse stress tests – Reviews Group-wide stress test results in accordance with risk appetite, reviews the risk outlook, reviews emerging risks – Oversees the bank’s climate and environmental risk framework topics with enterprise-wide risk implications |

|

| Non-Financial Risk Committee | – Chair: Chief Risk Officer – Vice Chair: Head of Non- Financial Risk Management |

– Representatives of key risk functions and specialists from business divisions and infrastructure functions | – Oversees, governs and coordinates the management of non-financial risks groupwide – Establishes a cross-risk and holistic perspective of the bank’s key non-financial risks, including risks to own infrastructure, employees and key processes, including those arising from climate risks |

|

| Group Reputational Risk Committee | – Co-Chair: Chief Risk Officer – Co-Chair: Head of Corporate Bank |

– Senior representatives of key infrastructure functions | – Responsible for the oversight, governance, and coordination of reputational risk management, including potential reputational risks arising from transactions linked to climate (and broader environmental and social) issues | |

| Transaction / client level |

Net Zero Forum (Corporate Bank and Investment Bank) | – Chair/Vice Chair: joint responsibility between business divisions, Risk and Chief Sustainability Office | – Senior sustainability specialists of business divisions, Risk, and Chief Sustainability Office | – Responsible for the assessment of new transactions with a significant impact on the bank’s net-zero targets and financed emissions as well as the assessment of client transition plans |

| Sustainable Finance Governance Forum | – Chair: Chief Sustainability Officer – Vice Chair: Head of Group Sustainability |

– Senior sustainability specialists of business divisions and infrastructure functions | – Reviews and discusses open questions on sustainable finance definition and product governance |