From shells to bitcoin

Since time immemorial, mankind has been inventive when it comes to exchanging goods and services.

In the beginning we made straight swaps – bartering one camel for ten sheep for example – then we relied on means of exchange such as salt or cowry shells, and later coins and banknotes. Every new method of payment has changed the economy and people’s habits. Digitisation is speeding up this process. Aspiring cryptocurrencies such as bitcoin and Ethereum are set to redefine the future of payments.

It started with a shell

Before money existed barter items served as proxies for the value of products and services. One well-known example is the cowry shell, which was widely used from around 2000 BC until the late 19th century as means of exchange or a payment in kind. Cowry shells were in circulation across one half of the globe as a counterfeit-proof, international “currency”. However, cowry "cash" was not the same as money in the sense of a currency, because it was not subject to government regulation and nor was there a banking system to accompany it.

Coins and paper

Traditional coin money first appeared around 700 BC and established itself slowly. Unlike cowry money, coins are designated by the government as legal tender and their issuance is regulated. Paper money first appeared in Europe during the 15th century in Spain, because there was a shortage of coin money.

In Germany, however, it wasn't until the 19th century that the public recognised the advantages for making large payments. Banknotes are lighter than coins and therefore much easier to transport. Coin money was almost completely wiped out by banknotes during World War I, because the metals used to make coins were needed to produce armaments. The coin share of money in circulation fell from 56 percent at the outbreak of war to 0.006 percent when the war ended.

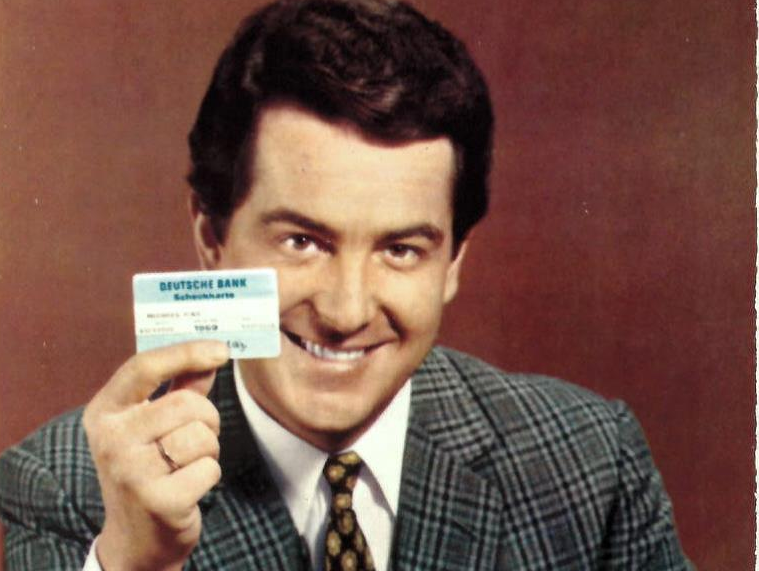

Cashless payments conquer the world

With the introduction of the first credit cards in the 1950s in the US and then worldwide, the payment habits of individuals changed markedly – and continue to evolve to this day. Now, during a holiday trip for example, you no longer have to plan your spending in advance and carry around large sums of cash – a major security benefit.

All because of a forgotten wallet

Invented by Frank McNamara in 1950, Diners Club ushered in the credit card era. Legend has it that in 1949 McNamara had forgotten his wallet when dining at his favourite New York restaurant and left his signed calling card as a deposit. To save himself from facing the same embarrassment again he is said to have founded Diners Club. It issued its first credit card in early 1950, and initially it was only valid in restaurants.

The Knights Templar already paid by travellers’ cheque

The first cashless payment methods were invented as early as the 12th century to facilitate foreign travel. Letters of credit from the Knights Templar – a precursor of the travellers’ cheque – were receipts issued to pilgrims for money they had deposited in Europe which they could redeem on their journey to the Holy Land at branches (commanderies) of the Templar.

Money from ATMs

Since the 1980s bank ATMs have provided much easier access to cash. Over time they have been given additional new functions, such as money transferral. As they are installed all over the world they offer fast, easy access to cash abroad as well.

Cashless payment becomes an everyday option

The introduction of mobile payment via a “chip & pin” debit card has allowed cashless payment in supermarkets and other shops selling staple items since 1990. All of a sudden off-the-cuff purchases were possible, even without any cash.

The bank in your pocket

With the triumphal march of the Internet and online sales, shopping has shifted to the virtual world. Payment systems such as PayPal have established themselves. They are supplemented by services integrated in smartphones such as Google Pay and Apple Pay.

Paying as you go

Today, work is already underway on the next steps for digital payment. At the moment it’s the customer who has to initiate a payment. However, automatic debiting could be introduced over the next few years. At the supermarket for example. When you place your items in a shopping trolley and walk out of the supermarket, the total amount is debited from your account automatically.

And in future? Payment by cryptocurrency?

Cryptocurrencies are the latest development in a long line of financial innovations. Currently they are still predominantly used by speculators. However, certain ones can already be used to pay and a variety of firms are considering accepting them as a means of payment.

Alexander Gallas

… is impressed how payment systems have developed over the millennia and how digitization is taking some age-old approaches to a new level.

Recommended content

Digital Disruption | Opinion

Bitcoin = digital gold? “I could potentially see Bitcoin become the 21st century gold”

Crypto-currencies are too important to ignore. Deutsche Bank Analyst Marion Laboure tells us how digital currencies will shape the future of payments.

Digital Disruption | Opinion

Inclusion through mobile payment “Mobile money is improving the way we do business in Ghana”

Mobile money is booming in the West African country. Eli Hini, CEO of MobileMoney Limited, explains why and describes how it promotes financial inclusion.

Digital Disruption | Getting started

Cash, card – or crypto? How the way you pay will affect your life

The trend has gained considerable momentum: 2020 saw the largest ever number of digital payments. The volume of cash that changed hands declined by one third instead.