General Statement on Observance of Anti-Money Laundering Requirements

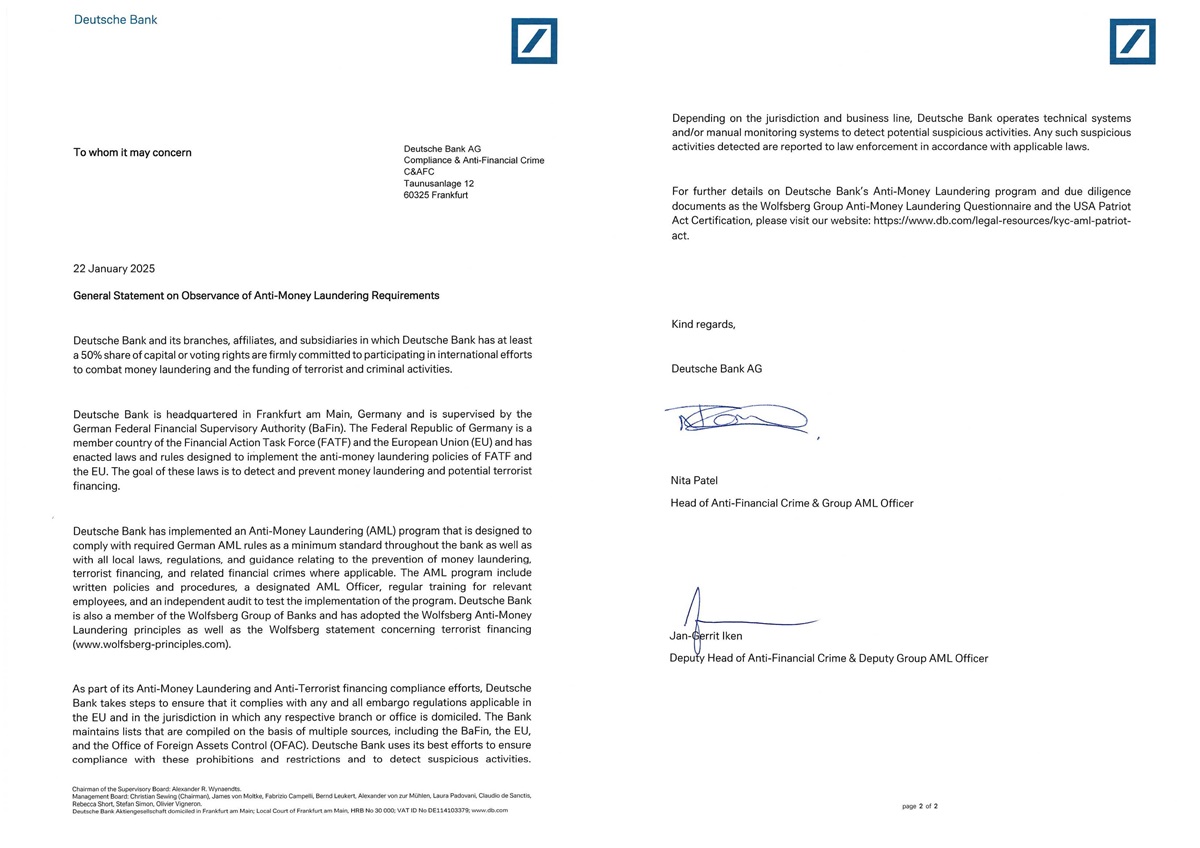

The content of following signed General Statement on Observance of Anti-Money Laundering Requirements can be found below the image.

Deutsche Bank and its branches, affiliates, and subsidiaries in which Deutsche Bank has at least a 50% share of capital or voting rights are firmly committed to participating in international efforts to combat money laundering and the funding of terrorist and criminal activities.

Deutsche Bank is headquartered in Frankfurt am Main, Germany and is supervised by the German Federal Financial Supervisory Authority (BaFin). The Federal Republic of Germany is a member country of the Financial Action Task Force (FATF) and the European Union (EU) and has enacted laws and rules designed to implement the anti-money laundering policies of FATF and the EU. The goal of these laws is to detect and prevent money laundering and potential terrorist financing.

Deutsche Bank has implemented an Anti-Money Laundering (AML) program that is designed to comply with required German AML rules as a minimum standard throughout the bank as well as with all local laws, regulations, and guidance relating to the prevention of money laundering, terrorist financing, and related financial crimes where applicable. The AML program include written policies and procedures, a designated AML Officer, regular training for relevant employees, and an independent audit to test the implementation of the program. Deutsche Bank is also a member of the Wolfsberg Group of Banks and has adopted the Wolfsberg Anti-Money Laundering principles as well as the Wolfsberg statement concerning terrorist financing (www.wolfsberg-principles.com).

As part of its Anti-Money Laundering and Anti-Terrorist financing compliance efforts, Deutsche Bank takes steps to ensure that it complies with any and all embargo regulations applicable in the EU and in the jurisdiction in which any respective branch or office is domiciled. The Bank maintains lists that are compiled on the basis of multiple sources, including the BaFin, the EU, and the Office of Foreign Assets Control (OFAC). Deutsche Bank uses its best efforts to ensure compliance with these prohibitions and restrictions and to detect suspicious activities. Depending on the jurisdiction and business line, Deutsche Bank operates technical systems and/or manual monitoring systems to detect potential suspicious activities. Any such suspicious activities detected are reported to law enforcement in accordance with applicable laws.

For further details on Deutsche Bank’s Anti-Money Laundering program and due diligence documents as the Wolfsberg Group Anti-Money Laundering Questionnaire and the USA Patriot Act Certification, please visit our website:

Kind regards,

Deutsche Bank AG

Signed by:

- Nita Patel, Head of Anti-Financial Crime & Group Anti-Money Laundering Officer

- Jan-Gerrit Iken, Deputy Head of Anti-Financial Crime & Deputy Group Anti-Money Laundering Officer